CPA Licensing Requirements

Updated January 18, 2024

The 2024 CPA Exam

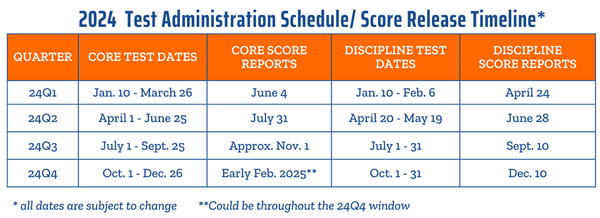

A new version of the CPA exam launched on Jan. 1, 2024. The new exam includes three core sections, plus one discipline section that the candidate may choose. Changes in the schedule for exam test windows and score release will also occur initially as the exam is rolled out.

- Download this summary of changes for 2024

- CPA Exam Section Details

- The Big Picture - Find out how the CPA Exam is evolving to meet marketplace demands.

- FAQs about the 2024 CPA Exam

See the table below for important dates that may impact your timing for testing in 2024.

CPA Exam Eligibility

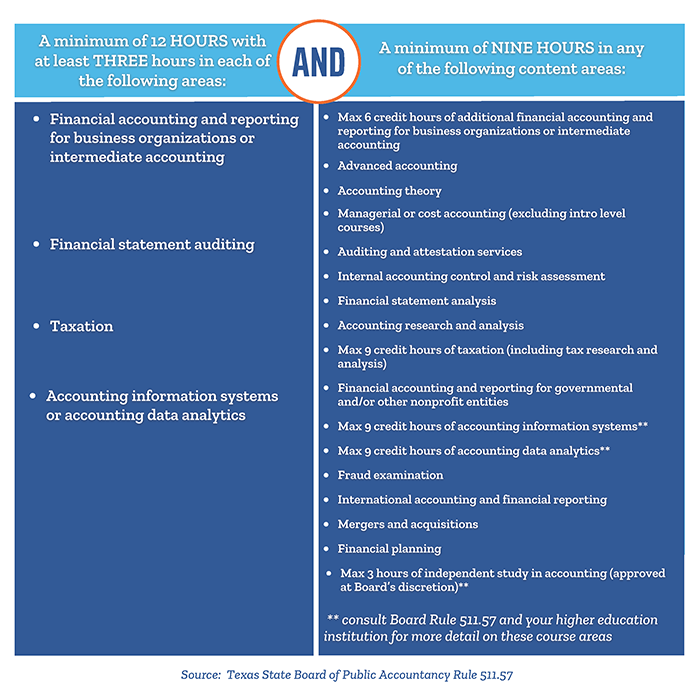

Effective September 1, 2023 , Texas CPA Exam candidates become eligible to begin testing at 120 hours of education credit, including 21 hours of upper-level accounting.

The upper-level accounting requirements can be fulfilled as follows:

Other Updates and Opportunities for Texas Students and Candidates:

- Notice to Schedule in Texas extended from 90 days to 180 days, effective Jan. 1, 2024

- Expiration of exam credits were also extended from 18 months to 30 months, effective Jan. 1, 2024

- The Applicant Reassessment Program from the Texas State Board of Public Accountancy invites those who lost exam credits between Jan. 1, 2020, and Jan. 1, 2024, due to expiration to reach out for potential reinstatement of those credits.

- The Texas State Board of Public Accountancy also announces expanded eligibility for their Accounting Student Scholarship Program.

Helpful Links

- TXCPA Student and Candidate Membership Options | Become a Member

- TXCPA Resources for Students and Candidates | Become a Texas CPA

- Texas State Board of Public Accountancy | TSBPA website

- National Association of State Boards of Accountancy | Obtaining a CPA License

- CPA Exam | Everything you need to know about the CPA Exam

- American Institute of CPAs | This Way to CPA Website